Carry out transactions with securities

Services:

Dealer operations

Brokerage services for individuals (residents/non-residents)

Purchase, sale of OVGZ, corporate bonds and other securities

Opening and servicing of client accounts on stock exchanges of Ukraine («Perspectivа», PFTS)

Opening and servicing of accounts in OJSC «Settlement Center» for bond trading

FUIB carries out operations with the following instruments:

- Domestic government bonds (OVGZ), denominated in UAH

- Domestic government loan bonds (OVGZ) denominated in foreign currency

- Corporate bonds

Advantages of domestic government bonds (OVGZ):

Taxation features of individuals transactions with OVGZ:

Military government bonds sale

The Ministry of Finance has published information on the auction for the sale of domestic government bonds at the Ministry of Finance Auction to be held on 29.10.2024:

| Bond code |

Additional accommodation |

Additional accommodation |

Additional accommodation |

Additional accommodation |

Additional accommodation |

| Term of circulation (days) | 336 | 567 | 924 | 1 197 | 386 |

| Number of issued bonds, (pcs.) | 5 000 000 | 5 000 000 | 5 000 000 | 5 000 000 | 200 000 |

| Profitability of the CB | 14.6% | 15.10% | 16.10% | 16.80% | 4.6% |

| Placement date | 29.10.2024 | 29.10.2024 | 29.10.2024 | 29.10.2024 | 29.10.2024 |

| Date of payment for purchased bonds | 30.10.2024 | 30.10.2024 | 30.10.2024 | 30.10.2024 | 30.10.2024 |

| Maturity date | 01.10.2025 | 20.05.2026 | 12.05.2027 | 09.02.2028 | 20.11.2025 |

|

Interest payment dates |

02.04.2025 |

20.11.2024 |

13.11.2024 |

12.02.2025 |

21.11.2024 |

FUIB has the following licenses of the National Commission for Securities and Stock Market:

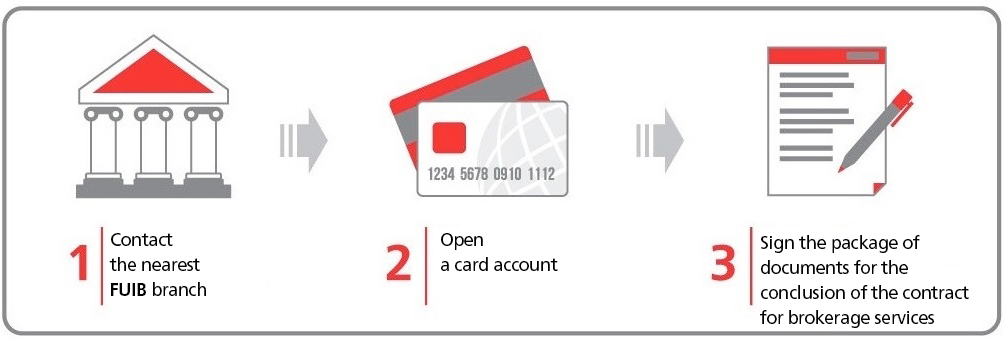

Becoming our client is simple:

Documents:

Helpful information:

Contacts:

Management of trading and brokerage operations

4 Andriivska str., Kyiv, Ukraine, 04070

Tel.: (044) 231-70- 53, (044) 231-73- 62

email: [email protected]

Securities documents in the established form and certain requisites that determine the monetary or other property rights of their owner and the person who issued them. It is possible to implement and transfer these rights only upon presentation of a security. Investments in securities — one of the popular ways of earning the money.

FUIB — one of the important players in the trading of securities in Ukraine. The Bank has all the required certificates and licenses for the legal implementation of such transactions.

Types of securities

It is possible to carry out operations in FUIB with the following securities:

Operations with securities in FUIB

The main way to earn money on securities — sale or purchase with changes in the exchange rate and the receipt of dividends. FUIB offers its clients such commission services:

FUIB bank offers favorable conditions for the purchase and sale of securities. We provide up-to-date information, give a certificate and calculate the degree of risk of an operation. FUIB gives an opportunity to conduct operations on the primary, secondary, stock market and over-the-counter market. At the same time, the client remains completely confidential.